When a doctor prescribes a biosimilar instead of the original biologic drug, the billing process isn’t as simple as swapping one pill for another. Unlike generic small-molecule drugs, biosimilars are complex biological products that require special coding and payment rules under Medicare Part B. Many providers still get confused by how these drugs are billed, leading to claim denials, delayed payments, and lost revenue. Understanding the current system isn’t just about paperwork-it affects whether patients get access to lower-cost treatments and whether clinics can afford to offer them.

How Biosimilars Are Different from Generics

It’s easy to assume biosimilars work like generic pills-cheaper copies approved after patents expire. But that’s not true. Biosimilars are made from living cells, not chemicals. Even tiny changes in manufacturing can affect how they work. That’s why the FDA doesn’t call them "interchangeable" unless they meet extra testing standards. Most biosimilars today aren’t interchangeable, so pharmacists can’t automatically swap them for the brand drug without the prescriber’s OK.

This complexity carries over into billing. Generics use the same National Drug Code (NDC) as the brand and are paid the same way. Biosimilars? Each one gets its own unique HCPCS code. That means if a patient gets Inflectra instead of Remicade, the provider can’t just bill the same code. They need to know exactly which biosimilar was used-and use the right code for it.

The Shift to Product-Specific Codes

Before 2018, all biosimilars for the same reference drug shared one HCPCS code. For example, Inflectra, Renflexis, and others for infliximab all used Q5101. CMS paid a blended rate based on the average price of all those drugs. Sounds fair, right? But it created a big problem: manufacturers of cheaper biosimilars were getting paid less than they should have because the payment was pulled down by the higher-priced ones. Why would a company launch a lower-cost biosimilar if it didn’t get full credit for its price?

In January 2018, CMS changed the rules. Now, every FDA-approved biosimilar gets its own code-either a Q-code (temporary) or J-code (permanent). Inflectra has J1745. Renflexis has J1746. Each has its own payment rate based on its actual Average Selling Price (ASP). This was a win for market competition. Now, a biosimilar that costs 30% less gets paid 30% less. No more hiding behind a blended rate.

How Payment Is Calculated

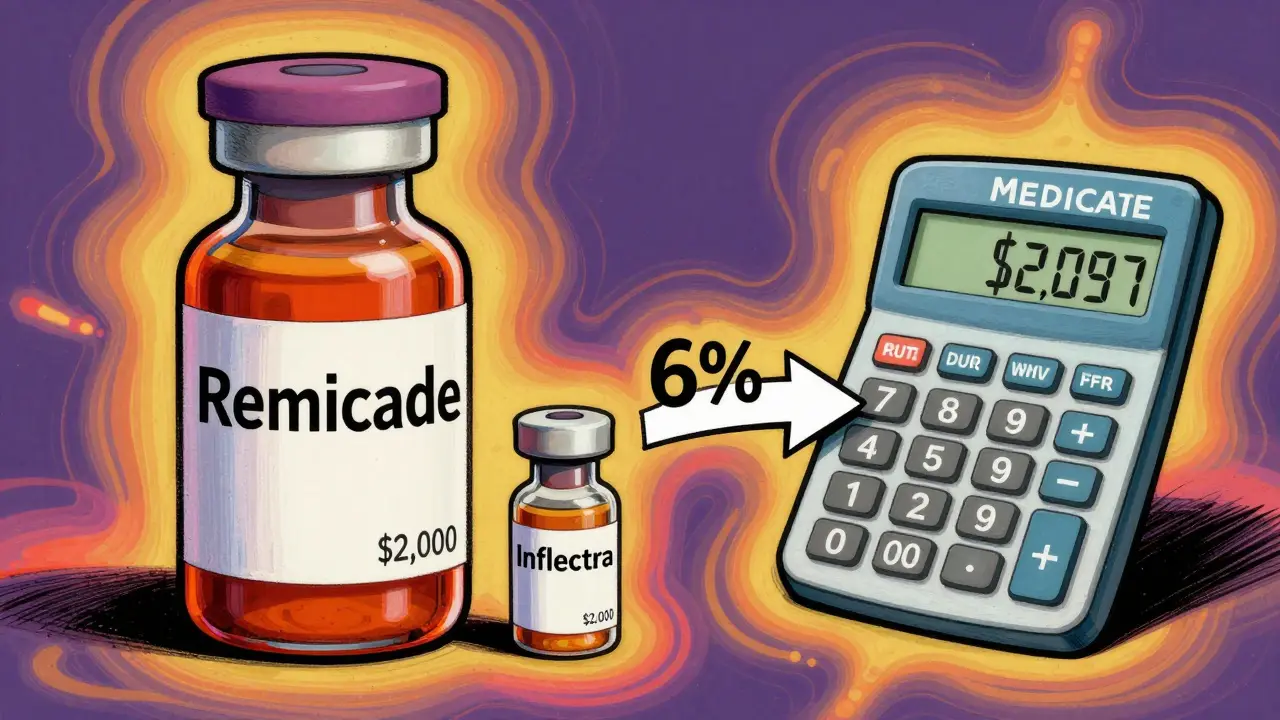

Medicare Part B pays for physician-administered drugs at 106% of ASP. That’s 100% for the drug cost plus a 6% add-on for handling and administration. For biosimilars, the rule is simple: 100% of the biosimilar’s ASP + 6% of the reference product’s ASP.

Let’s say Remicade (infliximab) sells for $2,500 per dose. Its ASP is $2,450. Inflectra sells for $2,000, with an ASP of $1,950. Here’s how payment breaks down:

- Remicade: 100% of $2,450 + 6% of $2,450 = $2,597

- Inflectra: 100% of $1,950 + 6% of $2,450 = $2,097

That means the provider gets $500 less for Inflectra-but only $100 less in profit. Why? Because the 6% add-on is based on the brand’s price, not the biosimilar’s. So even though Inflectra costs 20% less, the provider’s reimbursement difference is only about 19%. That small gap isn’t enough to push most clinics to switch.

Some experts call this a perverse incentive. Why would a clinic choose a cheaper drug if the profit difference is barely noticeable? A 2020 analysis from MIT’s Center for Biomedical Innovation found this structure reduces the financial motivation to use biosimilars. Eliminating the reference product’s ASP from the add-on could increase biosimilar use by 15-20 percentage points, according to Avalere Health.

The JZ Modifier: A New Layer of Complexity

On July 1, 2023, CMS added another requirement: the JZ modifier for infliximab and its biosimilars. This modifier tells Medicare that no drug was discarded during administration. If a provider opens a vial that holds 100 mg but only uses 80 mg, they’re supposed to report the discarded amount. But if they use the entire vial? Then they use JZ.

It sounds minor. But in practice, it’s added hours to billing workflows. One gastroenterology practice reported a 30% spike in staff time spent just verifying discarded amounts. If the modifier is missing or wrong, claims get denied. And since many biosimilars come in fixed-dose vials, it’s easy to accidentally miscode.

What Providers Are Doing Right-and Wrong

A 2022 survey of 217 cancer centers found that 68% struggled with the 2018 code switch. Forty-two percent had claims denied because they used the wrong HCPCS code. Many used outdated codes from before 2018. Others mixed up biosimilars from the same class-like confusing adalimumab biosimilars with infliximab ones.

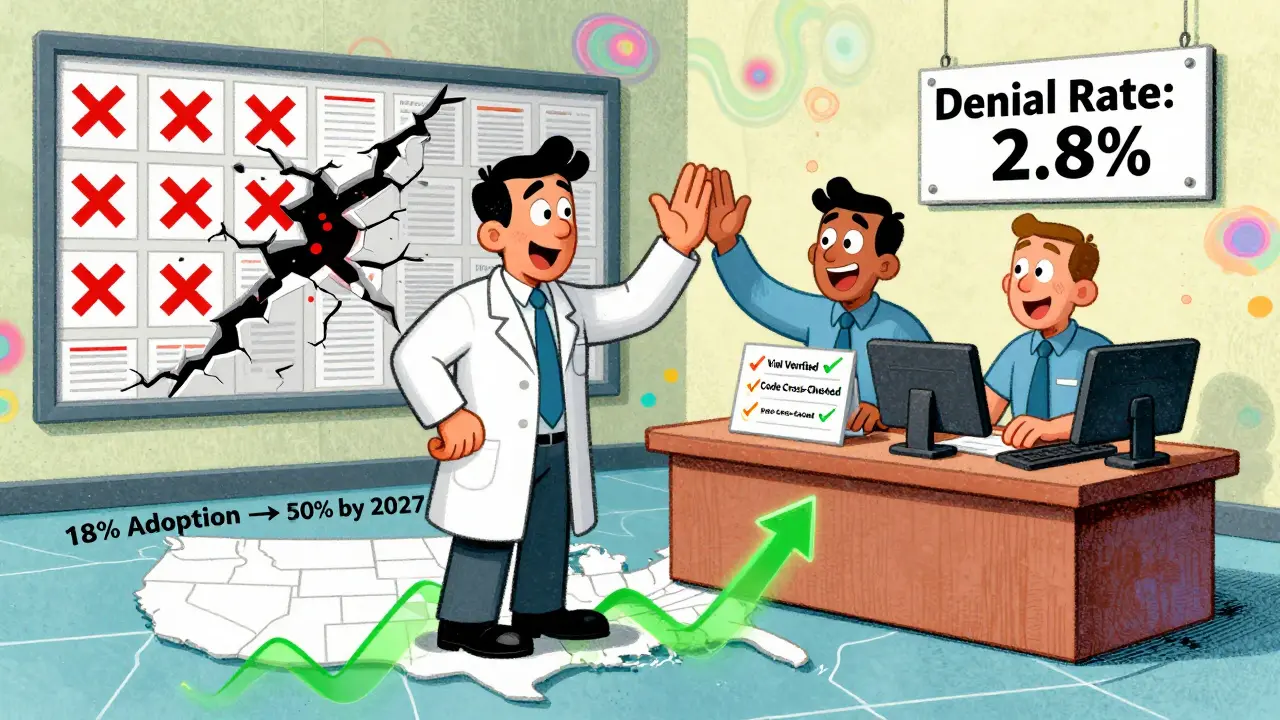

Successful clinics now use a two-step verification system:

- Pharmacy staff confirm the exact biosimilar administered (brand name, lot number, vial size).

- Billing staff cross-check that code against CMS’s latest quarterly pricing file before submitting.

Those clinics cut claim denial rates from 12-15% down to under 3%. That’s a huge difference in cash flow.

Manufacturers like Fresenius Kabi have helped by publishing free coding guides. One survey found 87% of providers rated their guides "helpful." But CMS’s own documentation? Only 58% of providers said it was enough to solve real-world billing problems.

Market Impact and Future Changes

As of 2023, the U.S. biosimilar market hit $12.3 billion-about 18% of the total biologics market. But adoption lags far behind Europe, where biosimilars make up 75-85% of usage. Why? In Europe, governments use reference pricing or tendering systems that force hospitals to pick the cheapest option. In the U.S., the 6% add-on structure softens the financial push.

CMS is now considering changes. In early 2023, they asked for public input on alternatives: Should the add-on be a flat dollar amount? Should it be based only on the biosimilar’s ASP? Or should Medicare pay the same rate for all drugs in a class-the "least costly alternative" model?

MedPAC recommended the LCA model in June 2023. If adopted, Medicare would pay 106% of the average price across all biosimilars and the reference drug. That would make switching even more attractive. But manufacturers warn it could hurt innovation.

Meanwhile, biosimilar companies time their launches to match CMS’s quarterly payment updates. They know the first few months after launch are critical for market share. The first biosimilar to enter a market often gets a temporary WAC-based payment (106% of wholesale cost) until enough ASP data is collected. After that, it’s all ASP-based.

What’s Next for Biosimilar Billing?

The system is stable-but not optimal. Providers are adapting, but they’re still stuck with a reimbursement model that doesn’t fully reward cost savings. The JZ modifier added friction. The 6% add-on still favors the brand. And CMS’s guidance, while accurate, doesn’t always translate to daily practice.

By 2027, analysts predict biosimilar use in the U.S. could reach 45-50%. But without changes to the payment structure, it won’t hit European levels. The real question isn’t whether biosimilars work-they do. It’s whether the system is built to make them the obvious choice.

For now, providers need to stay updated. Check CMS’s quarterly Physician Fee Schedule. Use manufacturer guides. Train staff on code changes. And don’t assume a biosimilar is just a cheaper version of the brand-when it comes to billing, it’s a completely different beast.

Do biosimilars use the same HCPCS code as the reference biologic?

No. Each biosimilar has its own unique HCPCS code, either a Q-code (temporary) or J-code (permanent). The reference biologic keeps its original code. For example, Remicade uses J1745, while Inflectra uses J1746. This change started in 2018 to ensure each biosimilar is paid based on its own price, not a blended average.

How is Medicare payment calculated for biosimilars?

Medicare pays 100% of the biosimilar’s Average Selling Price (ASP) plus 6% of the reference product’s ASP. For example, if a biosimilar’s ASP is $1,900 and the reference drug’s ASP is $2,400, the payment is $1,900 + (6% of $2,400) = $2,044. This structure means providers earn slightly less per dose from biosimilars, but the difference isn’t large enough to strongly incentivize switching.

What is the JZ modifier, and when do I use it?

The JZ modifier is required for infliximab and its biosimilars when no drug is discarded during administration. If you use the entire vial, you must add JZ to the claim. If you discard any portion, you report the discarded amount instead. This rule, effective July 1, 2023, adds documentation steps and has increased billing time for many providers.

Why do some biosimilars get paid more than others even if they’re cheaper?

They don’t. Each biosimilar is paid based on its own ASP. But because the 6% add-on is based on the reference product’s higher ASP, the payment difference between biosimilars and the brand is smaller than the price difference. A biosimilar that costs 25% less might only save the provider 15-20% in reimbursement, reducing the financial incentive to switch.

How often do CMS payment rates for biosimilars change?

CMS updates biosimilar payment rates quarterly, based on new ASP data submitted by manufacturers. The most recent update was July 1, 2023. Providers must check CMS’s Physician Fee Schedule and drug pricing files every three months to ensure they’re using the correct codes and payment amounts.

Can pharmacists automatically substitute a biosimilar for the brand drug?

Only if the biosimilar is FDA-designated as "interchangeable." As of 2026, only a handful of biosimilars have that status. Most require a prescriber to specifically order the biosimilar. Even then, state laws and payer rules may restrict substitution. Always check the prescription and payer policy before dispensing.

What happens if I bill the wrong HCPCS code for a biosimilar?

Claims will likely be denied or paid at the wrong rate. Many providers experienced denials during the 2018 transition when they used old shared codes. To avoid this, always verify the administered product against CMS’s current coding list. Use manufacturer-provided guides and implement a dual-check system between pharmacy and billing staff.

Next Steps for Providers

- Download the latest CMS quarterly drug pricing file from the Medicare Learning Network.

- Train pharmacy and billing staff on biosimilar coding every quarter.

- Use manufacturer coding guides-Fresenius Kabi, Sandoz, and Amgen all offer free resources.

- Implement a two-person verification system before submitting claims.

- Monitor your claim denial rates. If they’re above 5%, revisit your coding process.

Getting biosimilar billing right isn’t just about compliance. It’s about making sure patients get affordable care-and your practice stays financially healthy.

Ben McKibbin

January 21, 2026 AT 00:17Let’s be real - this whole 6% add-on on the reference drug’s ASP is a masterclass in bureaucratic nonsense. It’s like rewarding people for not switching to cheaper alternatives. If I buy a $20 coffee instead of a $25 one, I don’t want the barista getting paid the same amount anyway. Why should Medicare do the same? This isn’t just inefficient - it’s actively punishing cost savings. The system was designed to encourage competition, but it’s doing the opposite by making the math too subtle to matter.

And don’t get me started on the JZ modifier. A single letter that adds hours to billing workflows? That’s not innovation - that’s bureaucratic theater. Providers aren’t doctors who became accountants; they’re doctors who got stuck with a spreadsheet prison. CMS needs to simplify, not complicate.

Uju Megafu

January 22, 2026 AT 08:22Oh please. This is why American healthcare is a dumpster fire. You’ve got billion-dollar pharma companies gaming the system, and now we’re arguing over 6% add-ons like it’s a damn budget meeting at a middle school bake sale? The fact that biosimilars are still treated like second-class citizens in billing? Pathetic. And don’t even mention the JZ modifier - that’s not a code, that’s a trap for the untrained. Providers are drowning in paperwork while patients die waiting for affordable meds. This isn’t policy. It’s corporate sabotage dressed up as bureaucracy.

And who’s paying for all this? The patient. Again. Always the patient.

Jarrod Flesch

January 23, 2026 AT 22:21Big thanks for breaking this down - seriously, this is the clearest explanation I’ve seen. I work in a small clinic and we were getting denied left and right after 2018. The two-step verification? Game changer. We started using Sandoz’s guide and now our denial rate’s under 2%.

Also, the JZ modifier? Yeah, it’s annoying, but we just train everyone to check the vial label before administration. If it’s a 100mg vial and we use 95mg, we note it. If it’s all used? JZ. Simple. No drama. 🙌

Still think the 6% add-on is weird though. Why not just pay 106% of the biosimilar’s ASP? Then the incentive actually matches the savings.

Barbara Mahone

January 25, 2026 AT 16:11I appreciate the depth of this post. It’s rare to see such a nuanced look at reimbursement mechanics - most people just say "biosimilars are cheaper" and move on. The fact that the add-on is tied to the reference drug’s ASP instead of the biosimilar’s is indeed a structural flaw. It’s not malicious, just poorly aligned with economic incentives.

Also, the JZ modifier is a perfect example of how well-intentioned policy can become operational hell. I’ve seen clinics where nurses spend more time documenting discarded amounts than administering the drug. That’s not patient care - that’s paperwork theater.

Kelly McRainey Moore

January 26, 2026 AT 14:54This was super helpful! I’m a nurse in oncology and we just switched to a new biosimilar last month - I had no idea about the coding changes. Now I know why our billing team was so stressed 😅 Thanks for the tips on the two-step check and the manufacturer guides - we’re printing those out for our team tomorrow!

Stephen Rock

January 26, 2026 AT 20:40So the system is designed to make switching drugs financially meaningless. Cool. So why are we even pretending this is about cost savings? It’s not. It’s about protecting the brand. The JZ modifier? A distraction. The codes? A maze. The 6%? A joke. We’re not fixing healthcare. We’re just making the paperwork prettier while the patient pays more.

And don’t tell me about "market competition" - if the profit margin difference is 19% instead of 20%, that’s not competition. That’s a tax on common sense.

Ashok Sakra

January 27, 2026 AT 09:09Why you all so mad? Just use the cheap one! Why you care about code? Just give the medicine! Why you make so many words? I see this in India - they use biosimilar, no problem, no code, no modifier, no 6%. Just give medicine, get paid, patient happy. Why America so complicated? Just fix it. Why you waste time? I don’t understand. Just do it simple.

Andrew Rinaldi

January 28, 2026 AT 09:59It’s fascinating how a system meant to promote affordability ends up preserving the status quo through subtle financial mechanics. The 6% add-on doesn’t just distort incentives - it subtly reinforces the psychological perception that the brand is still the "real" drug, even when the biosimilar is clinically equivalent. We’re not just paying for drugs here; we’re paying for trust, history, and institutional inertia.

Maybe the real barrier isn’t cost or coding - it’s the cultural weight of the original brand name. No amount of ASP math will change that unless we change how we think about value in medicine.

Gerard Jordan

January 29, 2026 AT 02:06Big props to the author for laying this out so clearly 🙏

Just wanted to add - if you’re a provider reading this, don’t ignore the manufacturer guides. Fresenius Kabi’s PDFs are gold. Sandoz has a free app now that auto-checks codes against CMS updates. And Amgen’s training videos? 10/10. I’ve seen clinics go from 15% denials to 2% just by using these for staff training.

Also - if your billing team is still using 2017 codes? 😬 Time to schedule a 15-minute huddle. Your cash flow will thank you. 💰

And yes, the JZ modifier is annoying. But it’s just one extra checkbox. Fix the system? Yes. Ignore it? No. 🤝